Decentralized Exchanges, commonly referred to as DEX, represent a revolutionary shift in the way assets are exchanged in the digital realm. Unlike their centralized counterparts, DEXs operate without a central authority or intermediary, enabling peer-to-peer transactions in a trustless environment. This section delves deep into the world of DEX, shedding light on its definition, significance, and the fundamental differences from centralized exchanges.

What is a Decentralized Exchange (DEX)?

A Decentralized Exchange (DEX) is a platform that facilitates the direct exchange of cryptocurrencies between users, based on decentralized blockchain technology. Instead of relying on a third-party service to hold and manage the user’s funds, DEXs operate using smart contracts on blockchains, which automate and validate transactions without the need for intermediaries.

DEX vs. Centralized Exchanges (CEX)

| Feature | DEX | CEX |

|---|---|---|

| Control Over Funds | Users retain full control | Exchange has control |

| Security | Reduced risk of large-scale hacks | Vulnerable to major breaches |

| Anonymity | High (No mandatory KYC) | Low (KYC often required) |

| Liquidity | Can be lower than CEX | Generally high |

| User Interface | Can be complex for beginners | User-friendly |

Significance of DEX in the Crypto World

The rise of DEXs can be attributed to the growing demand for more privacy, control, and security in the crypto trading world. With increasing concerns about centralized exchanges being vulnerable to hacks, DEXs offer a safer alternative where users retain control over their private keys and funds. Moreover, DEXs uphold the ethos of decentralization, a core principle of blockchain technology, by ensuring that no single entity has control over the platform.

The Fundamental Difference

The primary distinction between a DEX and a Centralized Exchange (CEX) lies in the control and custody of funds. In a CEX, users deposit their funds into the exchange’s wallets, essentially giving up control. The exchange becomes responsible for the security and management of these funds. In contrast, on a DEX, users retain control of their private keys and funds, transacting directly from their wallets. This direct control reduces the risk of large-scale breaches and hacks, which have plagued many centralized exchanges in the past.

The Evolution of DEX

The journey of Decentralized Exchanges (DEX) is a testament to the relentless pursuit of decentralization and security in the crypto ecosystem. From humble beginnings to becoming a cornerstone of the decentralized finance (DeFi) movement, DEXs have come a long way. This section traces the evolution of DEXs, highlighting key milestones and the pivotal role of Ethereum in popularizing smart contracts and DEX platforms.

The Early Days of DEX

The concept of a decentralized exchange isn’t entirely new. The idea was floated around in the early days of Bitcoin, with the crypto community recognizing the need for an exchange system that aligns with the decentralized ethos of cryptocurrencies. However, the initial attempts were rudimentary, lacking the sophisticated infrastructure and user-friendly interfaces we see today.

Ethereum: The Catalyst for DEX Growth

Ethereum, launched in 2015, played a crucial role in the evolution of DEX. With its ability to execute smart contracts, Ethereum provided the perfect platform for developing decentralized applications, including exchanges. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This capability allowed for the creation of more complex and secure DEX platforms.

Platforms like Uniswap, Kyber Network, and 0x emerged, leveraging Ethereum’s smart contract functionality. These platforms introduced liquidity pools, automated market-making, and peer-to-peer protocols, revolutionizing the way users exchanged assets.

The Rise of DeFi and DEX Synergy

The decentralized finance (DeFi) movement, which gained significant traction in 2020, further propelled the popularity and adoption of DEXs. DeFi platforms aim to recreate traditional financial systems (like lending, borrowing, and yield farming) on the blockchain, without intermediaries. DEXs became the primary mode of exchanging assets within the DeFi ecosystem, given their decentralized nature.

As more users flocked to DeFi platforms, the volume and liquidity on DEXs surged. This symbiotic relationship between DeFi and DEX solidified the latter’s position in the crypto world.

Challenges and Innovations

While DEXs have seen exponential growth, they haven’t been without challenges. Issues like front-running, where malicious actors exploit the public nature of the blockchain to prioritize their transactions, emerged. However, the crypto community’s innovative spirit led to solutions like the introduction of Time Weighted Average Prices (TWAP) to combat such challenges.

Key Characteristics of DEX

Decentralized Exchanges (DEX) have distinct features that set them apart from traditional centralized exchanges. These characteristics not only define their operational framework but also underline the advantages they bring to the table. Let’s delve into the key attributes that make DEXs unique and transformative.

Peer-to-Peer Transactions

At the heart of every DEX is the principle of peer-to-peer (P2P) transactions. Unlike centralized platforms where an intermediary facilitates trades, DEXs allow users to trade directly with one another. This direct interaction ensures that users have full control over their trades, reducing the need for trust in a third party.

Role of Smart Contracts

Smart contracts are the backbone of DEXs. These are self-executing contracts with the terms of the agreement directly written into lines of code. On platforms like Ethereum, smart contracts automate and validate transactions on DEXs, ensuring they are executed as per the predefined rules without any manual intervention.

Decentralized Applications (DApps)

DEXs are often built as Decentralized Applications (DApps) on blockchain platforms. DApps are open-source applications that run on a decentralized network, ensuring that they are not controlled by any single entity. This decentralized nature ensures that DEXs are resistant to censorship and external manipulations.

On-chain and Off-chain Protocols

Some DEXs operate entirely on-chain, meaning all transactions are recorded on the blockchain. This ensures a high level of transparency and security. However, to address scalability issues, some DEXs use off-chain order books with on-chain settlements. This hybrid approach aims to combine the speed of off-chain processes with the security of on-chain settlements.

Liquidity Pools and Automated Market Makers (AMMs)

Traditional exchanges rely on order books to match buyers and sellers. In contrast, many DEXs use liquidity pools and AMMs to facilitate trades. Users provide liquidity by depositing their assets into a pool, and trades are made against this pool. AMMs determine the price based on the ratio of assets in the pool, ensuring that trades are executed even in the absence of a direct counterparty.

Advantages of DEX

The rise of Decentralized Exchanges (DEX) in the crypto landscape is not merely a trend; it’s a response to the inherent challenges posed by centralized systems. DEXs offer a myriad of benefits that cater to the demands of modern crypto enthusiasts. Let’s explore the key advantages that have propelled DEXs to the forefront of the crypto trading world.

Enhanced Security

One of the most significant advantages of DEXs is the enhanced security they offer. Since users retain control of their private keys and funds, the risk of large-scale breaches and hacks is substantially reduced. There’s no centralized point of failure, making it difficult for attackers to compromise the system.

Anonymity and Privacy

In a world where data privacy is a growing concern, DEXs provide a haven for those seeking anonymity. Most DEXs don’t require users to undergo Know Your Customer (KYC) processes, allowing them to trade without revealing their identities. This feature not only ensures privacy but also speeds up the trading process.

Direct Control Over Funds

On a DEX, users transact directly from their wallets. This means they have full custody and control over their funds at all times, eliminating the need to trust a third party with their assets. This direct control empowers users and reduces the chances of mismanagement or misuse of funds.

Global Accessibility

DEXs are accessible to anyone with an internet connection, regardless of their geographical location. This universal accessibility ensures that users from all over the world can participate in the crypto market without facing regional restrictions or biases.

Reduced Risk of Regulation and Shutdown

Centralized exchanges are often subject to regulatory pressures, which can lead to sudden shutdowns or restrictions. DEXs, being decentralized, are less susceptible to such interventions. Even if one access point or domain is shut down, the platform can still operate from different nodes or access points.

Transparent and Immutable Trading History

All trades on a DEX are recorded on the blockchain, ensuring a transparent and immutable trading history. This transparency builds trust among users and allows for easy verification of trades.

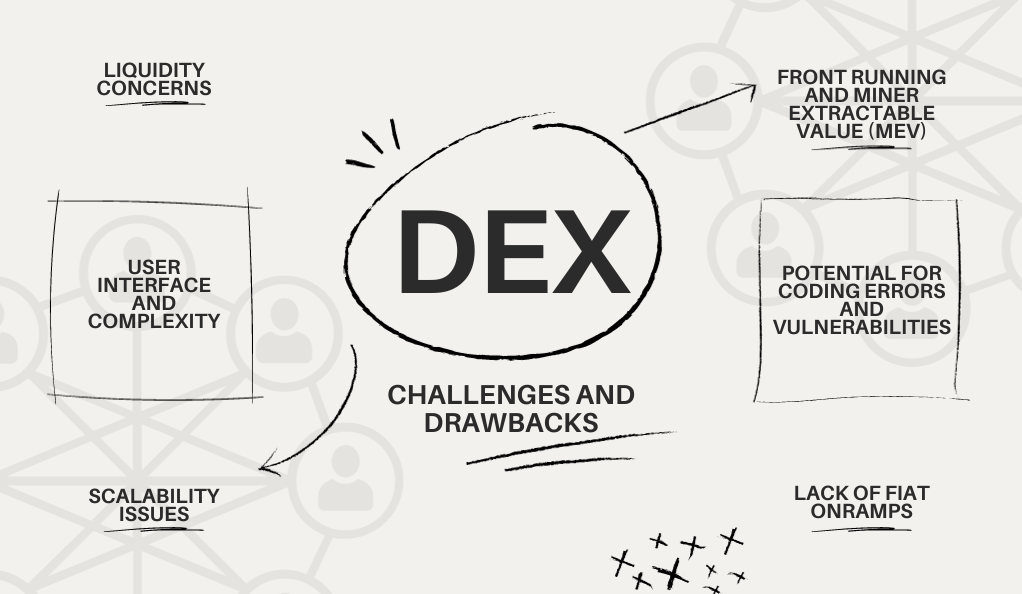

Challenges and Drawbacks of DEX

While Decentralized Exchanges (DEX) offer a plethora of advantages, they are not without their challenges. As with any emerging technology, DEXs face certain hurdles that need to be addressed for them to gain mainstream adoption. This section delves into the potential drawbacks and challenges associated with DEXs.

Liquidity Concerns: One of the primary challenges faced by many DEXs is liquidity. Centralized exchanges often have higher trading volumes, which ensures that large orders can be filled without significantly impacting the market price. In contrast, some DEXs struggle with lower liquidity, which can lead to price slippage, especially for large trades.

User Interface and Complexity: For newcomers to the crypto space, the user interface of some DEXs can be intimidating. The process of connecting wallets, understanding gas fees, and navigating the platform can be complex compared to the more user-friendly interfaces of centralized exchanges.

Potential for Coding Errors and Vulnerabilities: DEXs operate based on smart contracts. If these contracts are not coded correctly, they can have vulnerabilities that malicious actors might exploit. While the decentralized nature of DEXs offers enhanced security against hacks, they are not immune to potential coding errors or unforeseen smart contract exploits.

Front Running and Miner Extractable Value (MEV): In a DEX environment, transactions are public before they are mined. This transparency allows miners or other users to see pending transactions and potentially act on them before they are confirmed. This phenomenon, known as front running, can be exploited by those with the means to prioritize their transactions on the network.

Scalability Issues: As with many blockchain-based platforms, scalability can be a concern for DEXs. High demand can lead to network congestion, resulting in slower transaction times and higher gas fees. While solutions like layer 2 scaling and sidechains are being developed, scalability remains a challenge for many DEX platforms.

Lack of Fiat Onramps: Most DEXs focus solely on cryptocurrency trading, lacking direct fiat-to-crypto onramps. This limitation can be a barrier for new users who wish to enter the crypto space using traditional currencies.

The Future of DEX and Regulatory Landscape

The trajectory of Decentralized Exchanges (DEX) is intertwined with the broader evolution of the crypto space and the regulatory environment that surrounds it. As DEXs continue to gain traction, they face both opportunities for growth and challenges from regulatory bodies. This section delves into the potential future of DEXs and the regulatory landscape that could shape their path forward.

Potential Growth and Mainstream Adoption

The decentralized nature of DEXs, combined with the benefits they offer, positions them for significant growth in the coming years. As more users become aware of the advantages of decentralized trading, and as DEX platforms improve their user experience and address existing challenges, mainstream adoption is likely to increase.

Integration with Broader DeFi Ecosystem

The synergy between DEXs and the broader DeFi ecosystem will play a pivotal role in their future. As DeFi platforms expand their offerings, from lending and borrowing to insurance and derivatives, DEXs will serve as the primary hubs for asset exchange. This integration will further solidify the position of DEXs within the crypto landscape.

Regulatory Concerns and Challenges

As with many innovations in the crypto space, DEXs are on the radar of regulatory bodies worldwide. The decentralized nature of DEXs poses challenges for regulators, especially in areas like Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF). Some countries may seek to impose regulations on DEX operators or even users, which could impact the growth and adoption of these platforms.

Innovations in Cross-Chain Trading

One of the exciting frontiers for DEXs is cross-chain trading. As the crypto ecosystem grows, there are multiple blockchains with their native assets. DEXs that can facilitate trades across different blockchains will break barriers and offer users more flexibility and diversity in their trading options.

Enhanced Security and Privacy Features

The future will likely see DEXs incorporating more advanced security and privacy features. From zero-knowledge proofs to advanced encryption techniques, DEX platforms will continue to innovate to ensure user funds and data remain secure.

Education and Community Building

For DEXs to achieve widespread adoption, there will be a growing emphasis on education and community building. By educating users about the benefits and intricacies of decentralized trading and fostering a strong community, DEXs can ensure sustained growth and loyalty among users.

Conclusion

Decentralized Exchanges (DEX) stand as a testament to the transformative power of blockchain technology, encapsulating a vision of financial autonomy, security, and transparency. As we transition into an era where peer-to-peer interactions gain prominence, DEXs offer a glimpse into a future free from intermediary control, emphasizing collaboration and innovation. While challenges, particularly from a regulatory perspective, remain, the potential of DEXs to reshape the trading landscape and empower the unbanked is undeniable.

The dynamism of the crypto world ensures that DEXs will continue to evolve, adapting to changing needs and incorporating cutting-edge technologies. As we navigate this decentralized financial revolution, the role of DEXs becomes ever more pivotal, heralding a future that aligns seamlessly with the core principles of blockchain.