In the ever-evolving landscape of digital finance, the term “decentralized wallets” has emerged as a buzzword, capturing the attention of both tech enthusiasts and financial experts alike. But what exactly is a decentralized wallet, and why is it garnering such widespread interest?

At its core, a decentralized wallet represents a significant shift away from traditional financial systems. Unlike the centralized banking systems that most of us are familiar with, where financial institutions hold and manage our funds, decentralized wallets give individuals complete control over their assets. This means that users have direct ownership of their digital assets without the need for intermediaries.

| Aspect | Centralized System | Decentralized Wallet |

|---|---|---|

| Control | Held by financial institutions | Held by the individual user |

| Access | Through banking portals, often with fees | Direct, anytime, usually with minimal fees |

| Security | Dependent on the institution’s measures | User is responsible; enhanced by cryptography |

| Transparency | Limited; often opaque internal processes | Complete transparency with public ledgers |

| Asset Ownership | Institution holds assets on behalf of users | Direct ownership of digital assets |

Decentralized wallets operate on blockchain technology, a digital ledger that records all transactions across multiple computers. This ensures that the data is secure, transparent, and immutable.

The system records every transaction made through a decentralized wallet on the blockchain, providing a clear trail of all activities.

The rise of cryptocurrencies like Bitcoin and Ethereum has further propelled the popularity of decentralized wallets. These digital currencies operate outside the realm of traditional banking, offering a new way to think about money and value transfer. With decentralized wallets, users can send and receive cryptocurrencies, engage in smart contracts, and even participate in decentralized finance (DeFi) activities, all without the constraints of conventional financial systems.

What is a Decentralized Wallet?

A decentralized wallet, often referred to simply as a “crypto wallet,” is a digital tool that allows users to store, send, and receive cryptocurrencies.

Unlike traditional wallets that hold physical currency, a decentralized wallet holds two cryptographic keys. You share the public key with others to receive funds, and you keep the private key secret to authorize transactions and access the contents of the wallet.

The essence of decentralization lies in the fact that the wallet’s operation isn’t overseen or controlled by any central authority or financial institution. Instead, transactions are verified by a network of computers (nodes) on the blockchain. This decentralized nature ensures that the wallet’s security and functionality aren’t reliant on any single entity, reducing vulnerabilities and potential points of failure.

Key Features of Decentralized Wallets:

- Security: Cryptographic techniques secure transactions, ensuring that only the private key owner can access the funds.

- Transparency: They record all transactions.

- Control: Users have full control over their funds, without the need for intermediaries or third-party approvals.

- Interoperability: Many decentralized wallets support multiple cryptocurrencies, allowing users to manage diverse portfolios from a single interface.

- Global Access: You can access decentralized wallets from anywhere in the world, granting everyone universal access to digital assets.

Historical Context of Decentralized Wallets

The concept of decentralized wallets became prominent with the introduction of Bitcoin in 2008. Bitcoin, envisioned by an anonymous entity known as Satoshi Nakamoto, was presented as the first cryptocurrency operating on a decentralized network of computers. The foundational paper, “Bitcoin: A Peer-to-Peer Electronic Cash System,” described an electronic payment system that relied on cryptographic proof instead of trust. This revolutionary idea eliminated the need for centralized intermediaries, paving the way for a new era of financial autonomy.

Over the years, as more cryptocurrencies emerged, the need for secure and user-friendly wallets grew. These wallets evolved from simple software programs to sophisticated hardware devices, mobile applications, and even paper wallets. Each evolution aimed to enhance user experience, security, and functionality, catering to the diverse needs of the growing crypto community.

Today, decentralized wallets are more than just tools for storing cryptocurrencies. They have become gateways to the expansive world of decentralized finance (DeFi), enabling users to participate in lending, borrowing, staking, and various other financial activities, all on decentralized platforms.

Technology Behind Decentralized Wallets

Understanding the technology behind decentralized wallets is crucial to appreciating their transformative potential. At the heart of these wallets lies the intricate dance of cryptography, ensuring both security and accessibility.

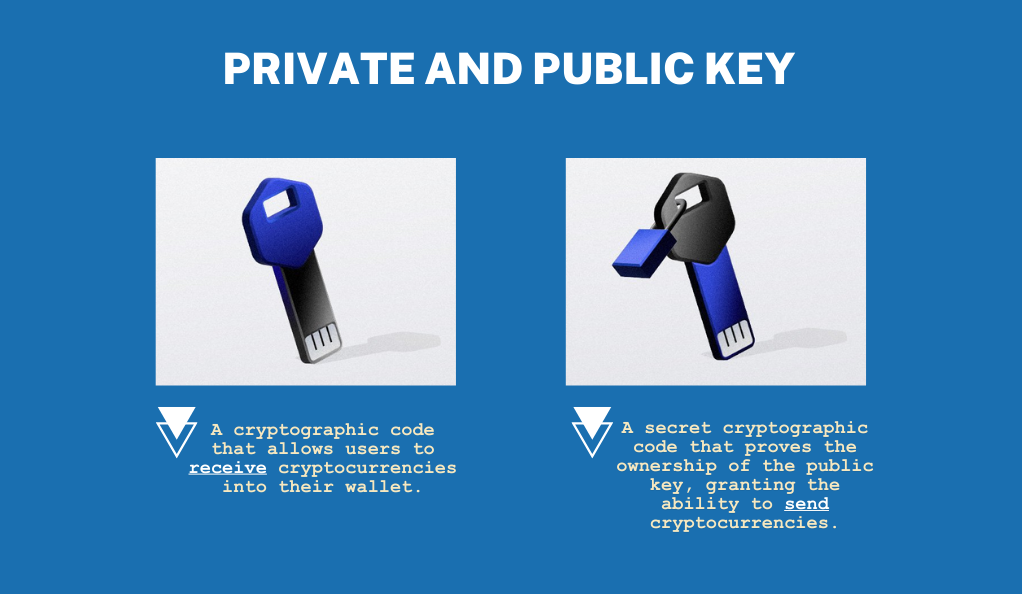

Private and Public Key Generation

Every decentralized wallet is associated with a pair of cryptographic keys: a public key and a private key. The public key is akin to an address that others can see and send funds to, while the private key is a secret passphrase that only the wallet owner should know, used to authorize transactions.

- Public Key: A cryptographic code that allows users to receive cryptocurrencies into their wallet.

- Private Key: A secret cryptographic code that proves the ownership of the public key, granting the ability to send cryptocurrencies.

The relationship between these keys is mathematical. While you can derive the public key from the private key, it’s computationally infeasible to do the reverse, which safeguards the wallet’s contents.

Seed Phrases

Modern wallets incorporate an additional security layer known as seed phrases. A seed phrase, typically a series of 12 to 24 random words, acts as a recovery tool. It’s an unencrypted representation of the wallet’s private key. In scenarios where a user might lose access to their wallet, the seed phrase can be used to restore access, ensuring that funds aren’t permanently lost.

Wallet Types and Storage Methods:

Decentralized wallets come in various forms, each offering different levels of security and convenience:

- Software Wallets: Installed on computers or smartphones, they offer a balance between security and accessibility.

- Hardware Wallets: Physical devices that store private keys offline, providing an added layer of security against online threats.

- Paper Wallets: Physical documents containing both the public and private keys, ensuring complete offline storage.

- Web Wallets: Accessed through web browsers, they offer convenience but rely on third-party platforms for security.

Types of Decentralized Wallets

The world of decentralized wallets is vast, with each type catering to specific needs and preferences:

- Brainwallets

A unique type where users memorize a passphrase (often a seed phrase). While offering plausible deniability, they are vulnerable to brute-force attacks if the passphrase isn’t complex enough. - DApp Browsers vs. Crypto Wallets

DApp browsers support decentralized applications built on blockchain technology, acting as gateways to various blockchain-based platforms. In contrast, crypto wallets focus primarily on managing and transacting digital assets. - Multisignature Wallets

These wallets add an extra layer of security by requiring multiple signatures (from multiple private keys) to authorize a transaction. They’re especially useful for organizations or joint accounts where consensus is needed for fund transfers. - Smart Contract Integration

Some advanced wallets integrate smart contract functionalities, allowing users to engage in complex transactions and agreements directly through their wallets.

Decentralized wallets are more than mere storage tools. They are gateways to a decentralized ecosystem, empowering users with financial autonomy and endless possibilities.

Benefits of Using Decentralized Wallets

The rise in popularity of decentralized wallets isn’t just a trend; it’s a reflection of the tangible benefits they offer over traditional financial systems. Here’s a closer look at the advantages that have made them a cornerstone of the digital finance revolution:

- Enhanced Security: Decentralized wallets leverage advanced cryptographic techniques, ensuring that transactions and wallet access are secure. Since there’s no central point of failure, risks associated with centralized hacks are significantly reduced. Moreover, with private keys held by the user, there’s a reduced risk of unauthorized access.

- Full Control and Ownership: Users have complete control over their funds in a decentralized wallet. There’s no need for third-party approvals or interventions, granting users unparalleled financial autonomy. This control ensures that users can access their funds anytime, anywhere, without restrictions.

- Transparency and Immutability: All transactions made through decentralized wallets are recorded on a public blockchain. This ledger is transparent, allowing anyone to verify transactions. Once a transaction is added to the blockchain, it becomes immutable, meaning it cannot be altered or deleted, ensuring trustworthiness.

- Reduced Costs: Decentralized wallets often offer lower transaction fees compared to traditional banking systems or centralized platforms. Without intermediaries, transactions are direct between parties, leading to faster settlements and reduced costs.

- Accessibility and Inclusion: Decentralized wallets can be accessed from anywhere in the world, requiring just an internet connection. This global accessibility ensures that even those without access to traditional banking systems can participate in the digital economy, fostering financial inclusion.

- Interoperability: Many modern decentralized wallets support a wide range of cryptocurrencies. This feature allows users to manage and transact multiple digital assets seamlessly, making it easier to participate in diverse blockchain ecosystems.

- Privacy: While transactions on a blockchain are transparent, they are also pseudonymous. This means that while transaction details are visible, the identities of the parties involved are not directly tied to their real-world identities, offering a degree of privacy.

Concerns and Precautions

While decentralized wallets offer numerous benefits, they also come with their set of challenges and concerns:

- User Responsibility: The autonomy that decentralized wallets offer also means that users are solely responsible for their wallet’s security. Losing access to one’s private key or seed phrase can result in permanent loss of funds.

- Lack of Regulation: The decentralized nature of these wallets means they often operate outside the purview of regulatory bodies. This can lead to potential legal gray areas and challenges.

- Technical Complexity: For those unfamiliar with blockchain technology, using and managing a decentralized wallet can seem daunting. It’s essential for users to educate themselves to navigate the ecosystem safely.

- Potential Vulnerabilities: While the decentralized system reduces many risks, it’s not entirely immune to threats. There have been instances of smart contract vulnerabilities or wallet software bugs leading to losses.

While decentralized wallets are transforming the financial landscape with their myriad benefits, users must approach them with an informed and cautious mindset. By understanding both their potential and their challenges, individuals can harness the power of decentralized finance while safeguarding their digital assets.

Conclusion: Embracing the Decentralized Financial Revolution

Decentralized wallets, as pillars of the burgeoning decentralized finance movement, represent a profound shift in our financial paradigm. They symbolize a future where financial autonomy, transparency, and inclusivity are not just ideals but everyday realities. Empowering individuals to be their own banks, these wallets challenge traditional norms and open doors to innovative platforms, from DeFi services to NFT marketplaces.

However, the journey towards complete decentralization is not without challenges. Issues like scalability, regulatory concerns, and user interface complexities need addressing. Yet, with a global community dedicated to innovation and problem-solving, the trajectory towards a more open, transparent, and inclusive financial system is clear. As we stand on the brink of this new era, embracing and understanding decentralized tools becomes essential for anyone looking to participate in the future of finance.