The financial world has been revolutionized with the advent of cryptocurrencies, introducing a new realm of digital assets that operate independently of central banks and traditional financial institutions. Cryptocurrencies, with Bitcoin leading the pack, have gained immense popularity and acceptance, albeit with a reputation for being highly volatile and unpredictable. This volatility, while a source of opportunity for traders and investors, also necessitates a deeper understanding of the factors that influence cryptocurrency prices.

Global events, ranging from political upheavals and economic crises to technological breakthroughs and regulatory changes, play a significant role in shaping the trajectory of cryptocurrency prices. The decentralized nature of cryptocurrencies means that they are not bound by the economic policies of any single country, making them particularly susceptible to the influence of worldwide occurrences.

In this article, we delve into the intricate relationship between global events and cryptocurrency prices, aiming to provide readers with a comprehensive understanding of how external factors can drive changes in the market. We will explore historical patterns, analyze specific case studies, and offer insights into strategies for predicting and mitigating the impact of global events on cryptocurrency investments.

Understanding Cryptocurrency and Its Market Dynamics

Cryptocurrency, at its core, is a form of digital or virtual currency that uses cryptography for security, making it extremely difficult to counterfeit or double-spend. It operates on a technology called blockchain, which is a decentralized technology spread across many computers that manage and record transactions. This decentralization is what sets cryptocurrencies apart from traditional currencies, providing a level of security and transparency that is not typically found in the traditional financial system.

The market dynamics of cryptocurrency are influenced by a variety of factors, both internal and external. Here are some of the key factors that play a role:

1. Supply and Demand

Like any other asset, the prices of cryptocurrencies are largely driven by supply and demand dynamics. If more people want to buy a cryptocurrency (demand) than sell it (supply), then the price moves up. Conversely, if more people want to sell a cryptocurrency than buy it, the price moves down.

2. Market Sentiment

The overall mood or attitude of investors towards a particular cryptocurrency or the market in general can have a significant impact on prices. Positive news stories about a cryptocurrency can lead to increased demand, while negative news can lead to panic selling.

3. Regulation News

Cryptocurrencies operate in a legal grey area in many parts of the world. News about governments implementing regulations can lead to price volatility. For example, announcements of stricter regulations or bans on cryptocurrencies in certain countries have led to sharp declines in prices in the past.

4. Technological Changes and Innovations

Advances in blockchain technology or the introduction of new features can also influence prices. For instance, an upgrade in a cryptocurrency’s system, such as a hard fork, can lead to price volatility.

5. Market Liquidity

Liquidity refers to how quickly a cryptocurrency can be bought or sold in the market without affecting its price. Cryptocurrencies with higher liquidity tend to be less volatile than those with lower liquidity.

6. Security Issues

Cryptocurrencies are digital and operate online, making them susceptible to hacks and security breaches. Instances of exchanges being hacked or coins being stolen can lead to a loss of trust among investors and a drop in prices.

Understanding these factors is crucial for anyone looking to invest in cryptocurrencies, as they can provide valuable insights into the potential movements in the market. By keeping a close eye on these factors, investors can make more informed decisions, potentially leading to more successful investments.

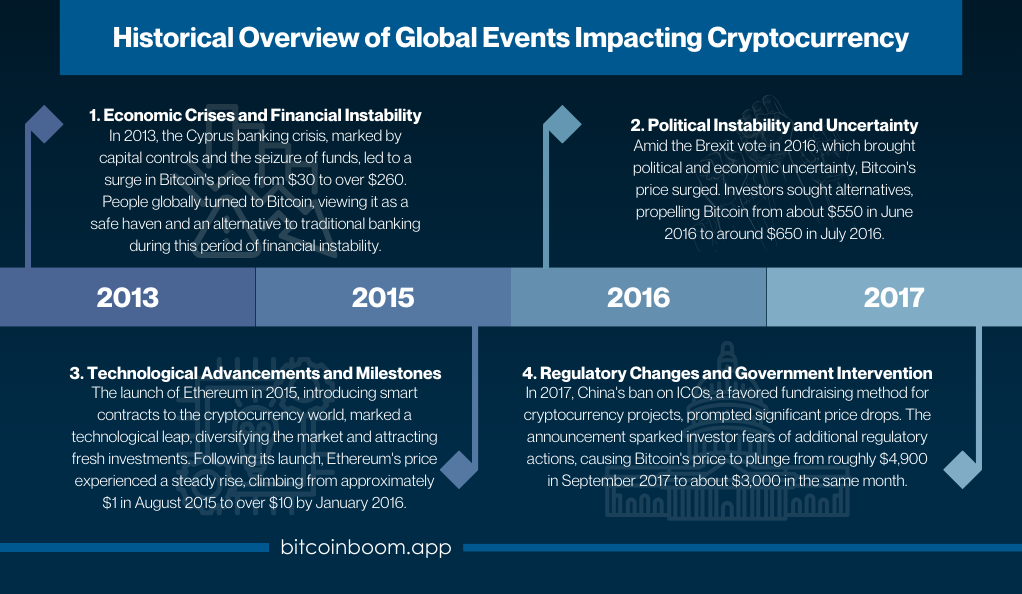

Historical Overview of Global Events Impacting Cryptocurrency

The volatile nature of cryptocurrency becomes evident when examining its history in relation to global events. Over the years, various incidents worldwide have left their mark on cryptocurrency prices, creating patterns and trends that investors and analysts closely watch. Below, we delve into some notable examples to illustrate the profound impact global events can have on the cryptocurrency market.

1. Economic Crises and Financial Instability

- Example: The Cyprus Banking Crisis (2013)

- Event Description: In 2013, Cyprus experienced a severe banking crisis, leading to the imposition of capital controls and the seizure of depositor funds.

- Impact on Cryptocurrency: Bitcoin’s price saw a significant surge during this period, as people in Cyprus and other parts of the world started viewing Bitcoin as a safe haven and an alternative to traditional banking.

- Price Movement: Bitcoin’s price rose from around $30 in March 2013 to over $260 in April 2013.

2. Political Instability and Uncertainty

- Example: Brexit (2016)

- Event Description: The United Kingdom voted to leave the European Union, leading to political and economic uncertainty.

- Impact on Cryptocurrency: The price of Bitcoin experienced a boost as investors looked for alternative assets amidst the uncertainty.

- Price Movement: Bitcoin’s price increased from around $550 in June 2016 to approximately $650 in July 2016.

3. Technological Advancements and Milestones

- Example: The Launch of Ethereum (2015)

- Event Description: Ethereum, a new cryptocurrency and blockchain platform that introduced smart contracts, was launched.

- Impact on Cryptocurrency: This technological advancement brought about a new era in the cryptocurrency world, diversifying the market and attracting new investments.

- Price Movement: Ethereum’s price steadily increased from around $1 in August 2015 to over $10 in January 2016.

4. Regulatory Changes and Government Intervention

- Example: China’s Ban on ICOs (Initial Coin Offerings) (2017)

- Event Description: The Chinese government announced a ban on ICOs, a popular method of fundraising for cryptocurrency projects.

- Impact on Cryptocurrency: The announcement led to a sharp decline in cryptocurrency prices as investors feared further regulatory crackdowns.

- Price Movement: Bitcoin’s price dropped from around $4,900 in September 2017 to approximately $3,000 in September 2017.

These examples underscore the sensitivity of the cryptocurrency market to global events. Whether it’s economic turmoil, political unrest, technological breakthroughs, or regulatory changes, each event has the potential to cause significant price movements. Investors and traders in the cryptocurrency space must remain vigilant and informed about global happenings to navigate the market effectively.

Types of Global Events That Influence Cryptocurrency Prices

Cryptocurrency markets are highly sensitive to various global events, with prices often reacting swiftly to news and developments from around the world. Understanding the types of events that can influence cryptocurrency prices is crucial for investors looking to navigate this volatile landscape. Below, we categorize and explain different types of global events and their typical impacts on the cryptocurrency market.

1. Economic Events

- Central Bank Policies: Changes in interest rates or monetary policies by major central banks can influence investor confidence and risk appetite, subsequently affecting cryptocurrency prices.

- Inflation and Currency Devaluation: High inflation rates or the devaluation of fiat currencies can lead to increased interest in cryptocurrencies as a store of value, potentially driving up prices.

- Financial Crises: Economic instability and financial crises can lead to a surge in cryptocurrency prices as investors seek alternative assets.

2. Political Events

- Elections and Policy Changes: Political elections and changes in government policies can create uncertainty, leading to increased interest in cryptocurrencies as a hedge against instability.

- Geopolitical Tensions: Escalating geopolitical tensions, such as trade wars or military conflicts, can drive investors towards cryptocurrencies as a perceived safe haven.

3. Regulatory Events

- Implementation of Regulations: Clear and favorable cryptocurrency regulations can provide legitimacy and boost investor confidence, potentially leading to price increases.

- Bans and Restrictive Policies: Conversely, bans or restrictive policies on cryptocurrencies or related activities can lead to sharp declines in prices.

4. Technological Events

- Network Upgrades and Forks: Significant upgrades or forks in a cryptocurrency’s blockchain can lead to price volatility as investors react to potential changes in the network’s functionality and value.

- Security Breaches: Hacks or security breaches of cryptocurrency exchanges or wallets can erode investor trust and lead to price declines.

5. Social and Cultural Events

- Mainstream Adoption: Positive news about the adoption of cryptocurrencies by major companies or governments can lead to increased demand and higher prices.

- Public Endorsements or Criticisms: Public statements by influential figures, either endorsing or criticizing cryptocurrencies, can have a significant impact on market sentiment and prices.

6. Environmental Events

- Energy Consumption Concerns: Concerns about the environmental impact of cryptocurrency mining, particularly regarding energy consumption, can lead to price volatility as investors weigh the sustainability of cryptocurrencies.

By understanding these different types of global events and their potential impacts on the cryptocurrency market, investors can make more informed decisions and develop strategies to mitigate risks and capitalize on opportunities. In the next section, we will delve into the role of media and public perception in shaping the impact of global events on cryptocurrency prices.

The Role of Media and Public Perception

The influence of media and public perception on cryptocurrency prices cannot be overstated. In a market driven by sentiment and speculation, news stories, social media posts, and public endorsements or criticisms can have immediate and significant impacts on price movements. Understanding this dynamic is crucial for anyone looking to navigate the cryptocurrency market.

1. Media Coverage

- Positive News: Stories highlighting the adoption of cryptocurrencies by major companies, technological advancements, or favorable regulatory developments can lead to increased investor interest and price surges.

- Negative News: Conversely, reports of security breaches, regulatory crackdowns, or high-profile criticisms can trigger panic selling and price declines.

- Rumors and Speculation: In some cases, even rumors or speculative reports can lead to price volatility, underscoring the market’s sensitivity to media coverage.

2. Social Media Influence

- Viral Trends: Cryptocurrency markets are particularly susceptible to viral social media trends, with platforms like Twitter and Reddit often serving as hubs for cryptocurrency discussions and speculation.

- Influencer Impact: Influential figures in the cryptocurrency space, or even celebrities who comment on cryptocurrencies, can sway market sentiment and influence price movements.

3. Public Perception and Sentiment

- Trust and Credibility: The overall trust in and credibility of cryptocurrencies in the public eye play a significant role in adoption rates and price stability.

- Fear, Uncertainty, and Doubt (FUD): The spread of fear, uncertainty, and doubt, whether founded or unfounded, can lead to negative market sentiment and price declines.

- Hype and FOMO (Fear of Missing Out): On the flip side, excessive hype and fear of missing out on potential gains can drive prices up in a speculative frenzy.

4. The Feedback Loop

- Price Movements Influence Perception: Just as media and public perception can influence price movements, the reverse is also true. Significant price increases can lead to positive media coverage and public sentiment, creating a feedback loop that further drives prices up.

- Managing Expectations: Investors need to be aware of this feedback loop and manage their expectations accordingly, recognizing that price movements are not always based on fundamental value.

In this complex interplay between media, public perception, and cryptocurrency prices, misinformation and hype can sometimes overshadow rational analysis and due diligence. Investors and traders must therefore approach media reports and public sentiment with a critical eye, seeking to differentiate between substantiated news and baseless speculation.

Strategies for Analyzing and Predicting Impacts

Navigating the volatile world of cryptocurrency requires more than just an understanding of market dynamics; it necessitates the development of strategies to analyze and predict the potential impacts of global events. In this section, we explore various tools and methodologies that investors can employ to make more informed decisions.

1. Fundamental Analysis

- Understanding the Basics: This involves evaluating a cryptocurrency’s underlying technology, its use cases, and its adoption rate. Investors should also consider the team behind the cryptocurrency and any partnerships or collaborations they have established.

- Economic Indicators: Pay attention to broader economic indicators such as inflation rates, GDP growth, and monetary policies, as these can influence investor sentiment and cryptocurrency prices.

2. Technical Analysis

- Chart Patterns and Trends: Analyzing price charts to identify patterns and trends can provide insights into potential future price movements.

- Indicators and Oscillators: Utilizing technical indicators like Moving Averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can help in making more informed predictions.

3. Sentiment Analysis

- Social Media and News Monitoring: Keeping a close eye on social media platforms and news outlets can provide real-time insights into market sentiment.

- Tools and Platforms: There are various tools and platforms available that aggregate and analyze social media posts and news articles to gauge the prevailing sentiment in the cryptocurrency market.

4. Risk Management

- Diversification: Spreading investments across different cryptocurrencies and asset classes can help in mitigating risks.

- Setting Stop-Loss and Take-Profit Levels: Establishing predefined levels at which to cut losses or take profits can help in managing risks and protecting investments.

5. Staying Informed and Updated

- Regular Research: Continuously educating oneself about the cryptocurrency market and staying updated on global events is crucial.

- Networking and Community Engagement: Engaging with other cryptocurrency enthusiasts and experts through forums, social media, and networking events can provide valuable insights and information.

6. Utilizing Predictive Analytics and Machine Learning

- Algorithmic Trading: Some investors use algorithmic trading bots that utilize machine learning algorithms to analyze market data and execute trades based on predefined criteria.

- Predictive Models: Developing predictive models based on historical data and various indicators can aid in forecasting potential price movements.

By employing a combination of these strategies, investors can enhance their ability to analyze and predict the impacts of global events on cryptocurrency prices. However, it is important to note that no strategy is foolproof, and investing in cryptocurrencies always carries inherent risks. Practicing due diligence, staying informed, and maintaining a disciplined approach to trading are key components of successful cryptocurrency investing.

Real-Life Examples and Case Studies

To further understand the impact of global events on cryptocurrency prices, it’s beneficial to examine real-life examples and case studies. These instances provide valuable insights and lessons that can guide investors in making informed decisions.

1. COVID-19 Pandemic and Cryptocurrency

- Event Description: The outbreak of the COVID-19 pandemic in early 2020 led to global economic uncertainty, market crashes, and unprecedented monetary policies.

- Impact on Cryptocurrency: Initially, cryptocurrencies like Bitcoin experienced a sharp decline in price, mirroring the panic selling seen in traditional markets. However, as central banks around the world started implementing quantitative easing and lowering interest rates, cryptocurrencies rebounded and saw significant price increases.

- Key Takeaway: This event highlighted the dual nature of cryptocurrencies as both risk assets and potential safe havens, demonstrating their sensitivity to global economic conditions.

2. Elon Musk’s Influence on Bitcoin and Dogecoin

- Event Description: Elon Musk, CEO of Tesla and SpaceX, has been vocal about cryptocurrencies, particularly Bitcoin and Dogecoin, through his social media platforms.

- Impact on Cryptocurrency: Musk’s tweets and comments have led to immediate and substantial price movements. For example, when he announced that Tesla would accept Bitcoin as payment, Bitcoin’s price surged. Conversely, when he later expressed concerns about Bitcoin’s environmental impact, the price dropped significantly.

- Key Takeaway: This case study underscores the significant impact that public endorsements or criticisms from influential figures can have on cryptocurrency prices.

3. China’s Crackdown on Cryptocurrency Mining

- Event Description: In mid-2021, China intensified its crackdown on cryptocurrency mining, citing environmental concerns and financial risks.

- Impact on Cryptocurrency: The crackdown led to a significant drop in Bitcoin’s hash rate (a measure of computational power used in mining and processing) and a decline in cryptocurrency prices.

- Key Takeaway: This event highlights the vulnerability of cryptocurrencies to regulatory actions and the importance of diversification in mining operations to mitigate risks.

4. The DeFi (Decentralized Finance) Boom

- Event Description: The rise of DeFi platforms, which offer decentralized lending, borrowing, and trading services, gained significant traction in 2020 and 2021.

- Impact on Cryptocurrency: The DeFi boom led to a surge in demand for Ethereum and other cryptocurrencies used on these platforms, driving up prices and increasing market volatility.

- Key Takeaway: This case study illustrates the potential for technological innovations and trends within the cryptocurrency space to drive market demand and price movements.

By analyzing these real-life examples, investors can gain a deeper understanding of how global events, public endorsements, regulatory changes, and technological trends can influence cryptocurrency prices. These case studies also highlight the importance of staying informed, diversifying investments, and being prepared for market volatility.

Future Outlook and Preparedness

As we look ahead, the relationship between global events and cryptocurrency prices is poised to remain complex and intertwined. The decentralized and digital nature of cryptocurrencies ensures that they will continue to be influenced by a myriad of factors on the global stage. In this section, we explore potential future scenarios and provide guidance on how investors can prepare for the impacts of global events on cryptocurrency prices.

1. Anticipating Technological Advancements

- Blockchain Innovations: Continued innovations in blockchain technology and the introduction of more efficient and secure protocols could lead to increased adoption and price appreciation of cryptocurrencies.

- Integration with Traditional Finance: The integration of cryptocurrencies with traditional financial systems and services could enhance their legitimacy and utility, potentially driving up prices.

2. Regulatory Landscape

- Global Standards and Regulations: The establishment of clear and consistent regulatory frameworks for cryptocurrencies across different countries could provide more stability and reduce uncertainty, potentially leading to price appreciation.

- Potential for Increased Scrutiny: Conversely, increased regulatory scrutiny and potential crackdowns on cryptocurrencies could lead to price volatility and declines.

3. Economic and Political Stability

- Global Economic Recovery: The recovery from the COVID-19 pandemic and stabilization of global economies could lead to reduced volatility in cryptocurrency prices.

- Potential for Economic Turbulence: Ongoing geopolitical tensions, economic disparities, and potential financial crises could increase demand for cryptocurrencies as alternative assets, leading to price fluctuations.

4. Environmental Concerns

- Sustainable Mining Practices: The adoption of more sustainable and energy-efficient cryptocurrency mining practices could address environmental concerns and contribute to price stability.

- Potential for Regulatory Actions: Continued concerns about the environmental impact of cryptocurrency mining could lead to regulatory actions that impact prices.

5. Public Perception and Adoption

- Mainstream Adoption: Increased acceptance and use of cryptocurrencies by businesses and consumers could drive demand and price appreciation.

- Potential for Hype and Speculation: The potential for hype and speculative trading in response to global events or trends could lead to price bubbles and subsequent corrections.

6. Preparedness and Risk Management

- Staying Informed: Investors should stay informed about global events, technological developments, and regulatory changes that could impact cryptocurrency prices.

- Diversification and Risk Mitigation: Diversifying investments across different cryptocurrencies and asset classes, and employing risk mitigation strategies, can help in navigating market volatility.

By anticipating potential future scenarios and adopting a proactive and informed approach to investing, individuals can better prepare for the impacts of global events on cryptocurrency prices. While the future remains uncertain, being well-prepared and vigilant will be key to navigating the volatile world of cryptocurrencies.

Conclusion: Navigating the Interconnected World of Cryptocurrencies and Global Events

In this comprehensive exploration, we’ve unraveled the complex relationship between global events and cryptocurrency prices, highlighting the market’s sensitivity to external factors. The decentralized and digital nature of cryptocurrencies places them at the epicenter of global shifts, reflecting changes in sentiment, economic conditions, and political landscapes. Investors and traders must navigate this volatile terrain with strategic analysis, informed decision-making, and a disciplined approach to risk management.

Looking ahead, the interplay between global events and cryptocurrency prices will continue to present both challenges and opportunities. By staying informed, diversifying investments, and employing a balanced perspective, individuals can navigate the market’s fluctuations, seizing opportunities while mitigating risks. In the ever-evolving world of cryptocurrencies, understanding the impact of global events is paramount, paving the way for informed investments and strategic navigation through the complexities of the digital financial landscape.