In the vast and intricate world of finance, institutional investors have long been the titans, wielding significant influence and capital. These entities, ranging from pension funds and insurance companies to hedge funds and sovereign wealth funds, have historically shaped the contours of global financial markets. But as the winds of change blow, bringing with them the allure of cryptocurrencies, how are these institutional behemoths responding? And more importantly, what does their involvement mean for the crypto market at large?

What are Institutional Investors?

At their core, institutional investors are entities that pool together vast sums of money to invest in securities, real estate, and other assets. Unlike individual or retail investors, they operate on a much larger scale, often managing billions or even trillions of dollars in assets. Their investment decisions, therefore, have the potential to significantly move markets.

| Type | Description |

|---|---|

| Pension Funds | Organizations that manage retirement funds for employees. |

| Insurance Companies | Firms that invest the premiums collected from their policyholders. |

| Hedge Funds | Private funds that employ various strategies to earn returns for their investors. |

| Sovereign Wealth Funds | State-owned investment funds that manage a country’s reserves, typically generated from commodities. |

| Endowments | Investment funds for institutions like universities, often used to support academic operations. |

| Mutual Funds | Investment vehicles that pool together money from many investors to purchase securities. |

Significance in Traditional Financial Markets

Historically, institutional investors have been the backbone of traditional financial markets. Their sheer size and scale mean that their investment strategies and decisions can influence asset prices, market trends, and even monetary policies. For instance, when a large pension fund decides to invest in a particular stock, the sheer volume of their purchase can drive up the stock’s price. Similarly, their exit from an asset class can lead to significant market corrections.

Historical Context of Institutional Investors

Before delving into the intricacies of institutional investors’ involvement in the crypto market, it’s essential to understand their historical context and the pivotal role they’ve played in shaping the financial world.

Origins and Evolution

Institutional investors, as we know them today, have their roots in the early financial systems of the 19th century. The rise of industrialization and global trade necessitated the pooling of resources to fund large-scale projects, leading to the birth of entities that could manage and invest vast sums of money.

- Pension Funds: One of the earliest forms of institutional investors, pension funds emerged as a way for companies to manage and invest their employees’ retirement savings. The goal was to ensure that workers had a secure financial future after their retirement.

- Mutual Funds: The 20th century saw the rise of mutual funds, which allowed individual investors to pool their resources and invest in a diversified portfolio. This democratized access to the stock market, previously reserved for the wealthy elite.

- Hedge Funds and Private Equity: The latter half of the 20th century introduced hedge funds and private equity firms. These entities employed sophisticated strategies to maximize returns, often operating with less regulatory oversight than other institutional forms.

Their Role in Traditional Financial Systems

Institutional investors have been the linchpins of global financial markets for over a century. Their influence can be seen in several key areas:

- Market Stability: By virtue of their size and long-term investment horizons, institutional investors often act as stabilizing forces in the market. Their large-scale investments can absorb market shocks and prevent drastic price fluctuations.

- Innovation and Financial Products: The needs and demands of institutional investors have led to the creation of various financial products and services. From complex derivatives to specialized investment vehicles, their influence has driven financial innovation.

- Globalization of Markets: Institutional investors have played a pivotal role in connecting global markets. Their cross-border investments have facilitated the flow of capital across countries, making the world’s financial systems more interconnected than ever.

Transition to the Crypto Market

The allure of the crypto market is undeniable. With its rapid growth, high returns, and the promise of a decentralized financial future, cryptocurrencies have caught the attention of investors worldwide. But for institutional investors, traditionally accustomed to regulated and well-established markets, the transition to this new frontier is both intriguing and challenging.

Why are Institutional Investors Eyeing the Crypto Market?

Several factors have piqued the interest of institutional investors in the realm of cryptocurrencies:

- Diversification: Cryptocurrencies offer a new asset class, distinct from traditional stocks, bonds, and commodities. This provides an opportunity for portfolio diversification, potentially hedging against market downturns in other areas.

- High Returns: The crypto market, especially in its earlier days, has seen exponential growth. Bitcoin’s meteoric rise, for instance, has outperformed many traditional investments.

- Innovation and Future Potential: Beyond mere speculation, many institutional investors recognize the transformative potential of blockchain technology, the underlying framework of cryptocurrencies. This technology promises to revolutionize sectors from finance and supply chain to healthcare and governance.

- Growing Acceptance: As regulatory clarity improves and more mainstream financial structures, like futures and ETFs, incorporate cryptocurrencies, the legitimacy and acceptance of crypto assets among institutional players are growing.

| Year | Market Cap | Notable Events |

|---|---|---|

| 2010 | $1.6 Million | Bitcoin’s first real-world transaction. |

| 2015 | $4.3 Billion | Ethereum launches, introducing smart contracts. |

| 2020 | $330 Billion | Bitcoin halving event; DeFi boom begins. |

| 2023 | $1.2 Trillion | Increased institutional involvement; regulatory clarity. |

Challenges in the Transition

While the potential rewards are high, institutional investors face several challenges in the crypto market:

- Regulatory Uncertainty: The crypto landscape is still evolving, and regulatory frameworks vary widely across countries. This uncertainty can be a significant barrier for institutions that require clear legal guidelines.

- Security Concerns: High-profile hacks and breaches in crypto exchanges have raised concerns about the security of digital assets.

- Market Volatility: The crypto market is known for its price volatility. While this can lead to high returns, it also introduces a higher risk factor, especially for conservative institutional investors.

- Lack of Traditional Infrastructure: The absence of well-established custodial services, insurance mechanisms, and other traditional financial infrastructures can be a deterrent.

Influence on Crypto Market Dynamics

The entry of institutional investors into the crypto market has brought about significant changes in market dynamics. Their involvement has not only added legitimacy to the crypto space but has also introduced new patterns of trading, investment strategies, and market behaviors.

Stabilizing Influence

One of the most notable impacts of institutional involvement is the potential stabilization of the crypto market. Given their long-term investment horizons and risk-averse nature, institutional investors are less likely to engage in speculative trading. This can reduce the extreme volatility often associated with cryptocurrencies.

For instance, when a major institutional player announces a substantial investment in a particular cryptocurrency, it often leads to a more sustained price increase rather than a short-lived spike. This is because such investments are usually perceived as a vote of confidence in the long-term viability of the asset.

Mainstream Adoption and Legitimacy

Institutional investments have played a pivotal role in pushing cryptocurrencies towards mainstream acceptance. As these traditional financial powerhouses venture into the crypto space, it sends a strong signal to retail investors and the general public about the legitimacy of digital assets.

Moreover, their involvement often leads to the development of more sophisticated financial products around cryptocurrencies, such as crypto ETFs, futures contracts, and more. These products make it easier for other institutional and retail investors to enter the market, further driving adoption.

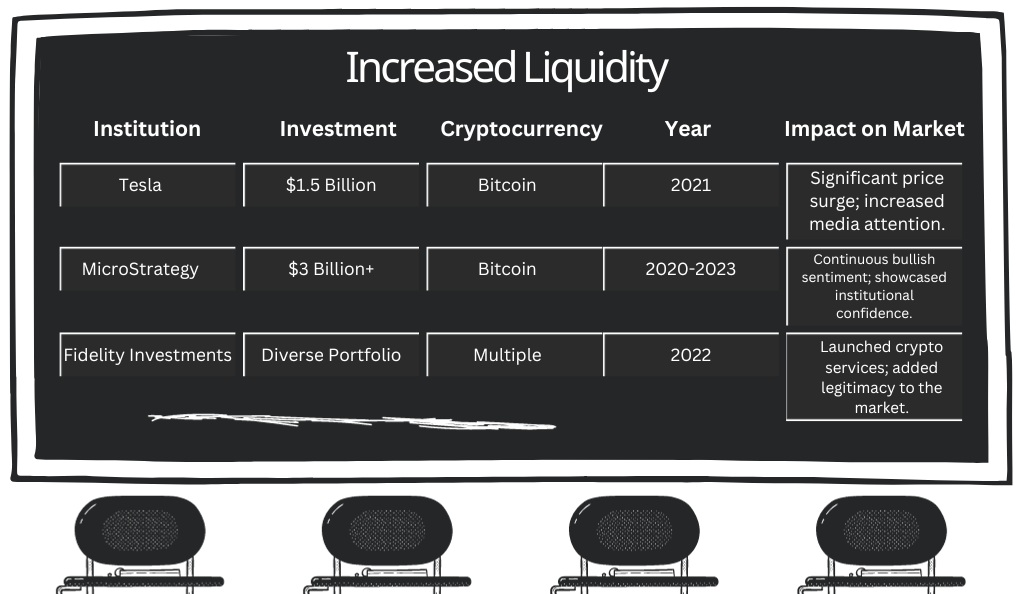

Increased Liquidity

With the influx of large-scale investments from institutional players, the crypto market has seen a significant increase in liquidity. This means that large transactions can now be executed without causing drastic price changes, making the market more efficient and attractive to other large investors.

Potential Pitfalls

While the involvement of institutional investors has many positive impacts, it’s essential to recognize potential pitfalls. Their significant influence means that decisions made by a few key players can sway the market. For instance, if a major institution decides to liquidate a substantial crypto holding, it could lead to short-term market panic.

Furthermore, the crypto market’s decentralized ethos could be at odds with the centralized nature of many institutional players, leading to potential conflicts of interest and market manipulation concerns.

Challenges Faced by Institutional Investors in Crypto

The allure of the crypto market is undeniable, but it comes with its own set of challenges, especially for institutional investors accustomed to the more predictable world of traditional finance. Their entry into this nascent space has been met with both opportunities and obstacles.

Regulatory Hurdles

Navigating the regulatory landscape of the crypto world is perhaps the most significant challenge for institutional investors. Cryptocurrencies, given their decentralized nature and global reach, pose unique regulatory concerns:

- Inconsistent Global Regulations: Different countries have varied approaches to crypto. While some nations have embraced it, others have imposed strict regulations or outright bans. This patchwork of policies can be a minefield for institutions with a global footprint.

- Evolving Regulatory Framework: As the crypto market matures, regulatory frameworks are continuously evolving. Institutions have to stay updated and compliant, which requires significant resources and expertise.

Security Concerns and Risk Management

The decentralized nature of cryptocurrencies brings about unique security challenges:

- Exchange and Wallet Vulnerabilities: Over the years, several crypto exchanges and wallets have been targets of high-profile hacks, leading to significant losses. For institutional investors managing vast sums, ensuring the security of their digital assets is paramount.

- Custody Solutions: Traditional banking systems offer established custodial solutions. In contrast, the crypto world is still developing reliable custody solutions that meet the standards and needs of institutional players.

Market Volatility

The crypto market is known for its price volatility, which can be a double-edged sword:

- Potential for High Returns: While volatility can lead to high returns, it also introduces a higher risk factor. For conservative institutional investors, this unpredictability can be a deterrent.

- Liquidity Concerns: Despite the growing market capitalization of cryptocurrencies, certain assets or tokens might not have enough liquidity, making it challenging for institutions to make large trades without affecting prices.

Lack of Established Infrastructure

The crypto market, though advanced in many ways, still lacks some of the infrastructures that institutional investors are accustomed to:

- Reporting and Auditing: Traditional markets have established practices for financial reporting and auditing. The crypto space is still developing these standards, making it challenging for institutions to maintain transparency and compliance.

- Insurance Mechanisms: While some progress has been made, comprehensive insurance mechanisms for digital assets are still in their infancy. This poses challenges for institutions that need to safeguard their investments.

Conclusion

The crypto market, once a fringe element of the financial world, has rapidly ascended to prominence, capturing the attention of retail and institutional investors alike. As we’ve explored in this article, institutional investors, with their vast resources and influence, have the potential to significantly shape the trajectory of the crypto landscape. Their entry into this domain brings with it a mix of opportunities and challenges.

From the historical roots of institutional investing to their current foray into the crypto realm, it’s evident that their involvement is a double-edged sword. While they lend legitimacy, stability, and increased liquidity to the market, their presence also introduces new dynamics, challenges, and potential pitfalls.

As the crypto ecosystem continues to mature, the role of institutional investors will undoubtedly evolve. Their challenges, from regulatory hurdles to security concerns, will likely find solutions as the market innovates and adapts. The marriage of traditional finance with the revolutionary world of crypto promises a future filled with possibilities, innovations, and transformations.