In the digital age, the concept of money has undergone a significant transformation. Enter cryptocurrencies: a revolutionary form of digital or virtual currency built on the foundation of blockchain technology. Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on a decentralized platform, promising transparency, security, and reduced transaction fees. This introduction aims to shed light on the essence of cryptocurrencies and their growing role in the global financial ecosystem.

What are Cryptocurrencies?

Cryptocurrencies are digital or virtual currencies that use cryptography for security, making them resistant to counterfeiting. Unlike traditional currencies, they are not issued by any central authority, rendering them theoretically immune to government interference or manipulation. The most distinguishing feature of cryptocurrencies is their decentralized nature, which is achieved through the use of blockchain technology—a distributed ledger enforced by a diverse network of computers.

| Feature | Description |

|---|---|

| Decentralization | Operates independently of a central bank or authority. |

| Transparency | All transactions are recorded on a public ledger, accessible to anyone. |

| Security | Cryptographic techniques ensure the security and integrity of transactions. |

| Anonymity | Users can make transactions without revealing their identities, though the transaction details are public. |

| Global and Digital | Not tied to any country or government, making them truly global. |

The Rise of Bitcoin and Altcoins

Bitcoin, introduced in 2009 by an anonymous entity known as Satoshi Nakamoto, is the pioneer and by far the most well-known cryptocurrency. Its inception was rooted in the idea of creating a currency independent of any central authority, transferable electronically with very low transaction fees. Following Bitcoin’s success, thousands of alternative cryptocurrencies, often referred to as “altcoins,” emerged. These altcoins, such as Ethereum, Ripple, and Litecoin, offer variations in terms of transaction speed, security features, and consensus algorithms.

Why the Buzz Around Cryptocurrencies?

The allure of cryptocurrencies lies in their potential to revolutionize the financial industry. They promise faster transaction times, reduced fees, financial inclusion for those without access to traditional banking systems, and a level of anonymity not offered by traditional currencies. Moreover, the underlying technology, blockchain, has applications far beyond cryptocurrencies, including supply chain management, healthcare, and voting systems, to name a few.

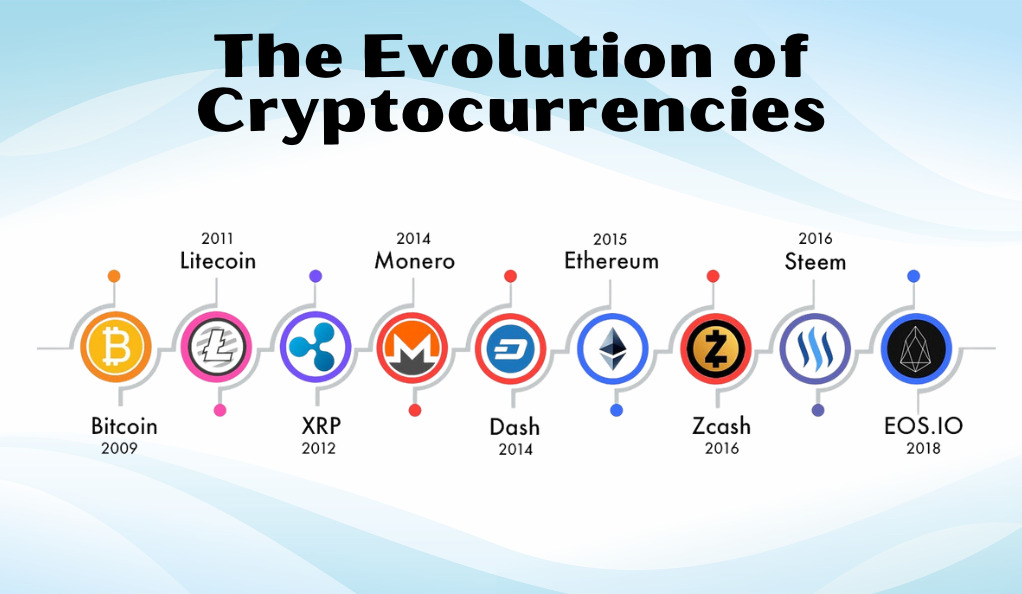

The Evolution of Cryptocurrencies

The journey of cryptocurrencies from a mere concept to a formidable force in the financial world is nothing short of fascinating. This section traces the evolution of cryptocurrencies, highlighting key milestones and innovations that have shaped their trajectory.

The Genesis: Bitcoin’s Whitepaper

The story begins in 2008 when an individual or group under the pseudonym Satoshi Nakamoto released a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This document laid out the blueprint for a decentralized digital currency system, where transactions could be verified without the need for a central authority. A year later, in 2009, Nakamoto mined the first-ever Bitcoin block, known as the “genesis block,” marking the birth of Bitcoin.

The Rise of Altcoins

While Bitcoin was the trailblazer, it wasn’t long before other cryptocurrencies started to emerge. These were termed “altcoins” (alternative coins). Some of the earliest altcoins included Namecoin (2011) and Litecoin (2011). Each altcoin brought with it unique features or variations—whether in terms of transaction speed, mining mechanisms, or other functionalities.

For instance:

- Litecoin was marketed as the “silver to Bitcoin’s gold,” offering faster transaction times.

- Ripple (XRP) introduced a consensus ledger that didn’t require mining, distinguishing itself from Bitcoin and many other cryptocurrencies.

The ICO Boom

2017 was a watershed year for cryptocurrencies, marked by the Initial Coin Offering (ICO) boom. ICOs are fundraising mechanisms where new cryptocurrencies sell their underlying tokens in exchange for Bitcoin or Ethereum. This period saw a surge in new cryptocurrency projects, with many startups raising millions in mere minutes. However, the ICO frenzy also led to increased scrutiny from regulators due to concerns over fraud and investor protection.

Mainstream Recognition and Adoption

Over the years, cryptocurrencies began gaining recognition from mainstream financial institutions and investors. In 2020, Bitcoin experienced a significant surge in value, partly driven by institutional investment and companies like Tesla announcing their support for the digital currency. Moreover, payment platforms like PayPal started offering cryptocurrency services, further cementing their place in the mainstream financial ecosystem.

Challenges Along the Way

While the journey of cryptocurrencies has been marked by significant milestones, it hasn’t been without challenges. Issues like regulatory concerns, security breaches (such as the infamous Mt. Gox hack), and market volatility have often cast shadows over the potential of cryptocurrencies.

The Promise of Decentralization

Central to the allure of cryptocurrencies is the principle of decentralization. This section delves into the essence of this concept, its implications, and the transformative potential it holds for the financial world and beyond.

Understanding Decentralization

In traditional systems, whether it’s banking, governance, or any other sector, there’s typically a central authority—a singular entity or group that holds power and control. Decentralization, on the other hand, distributes this power across a network, eliminating the need for intermediaries.

In the context of cryptocurrencies, decentralization means that no single entity, like a central bank or government, controls the currency or its monetary policy. Instead, transactions occur directly between users and are verified by network nodes through cryptography.

Benefits of Decentralization

- Enhanced Security: Decentralized systems are inherently more secure. Since there’s no central point of failure, they are less vulnerable to hacks or centralized attacks.

- Transparency and Immutability: All transactions on a decentralized network are recorded on a public ledger (blockchain) that anyone can access. Once added, these records cannot be altered, ensuring transparency and trustworthiness.

- Reduced Costs: Eliminating intermediaries means fewer fees and faster transactions. This is especially beneficial for international transfers, which can be costly and slow in traditional banking systems.

- Empowerment and Autonomy: Decentralization gives individuals more control over their assets. They can transact without needing approval from any authority, and their funds can’t be seized or frozen.

Decentralization Beyond Cryptocurrencies

The principle of decentralization, while foundational to cryptocurrencies, has applications beyond just digital currencies. Decentralized Finance (DeFi) platforms are aiming to recreate traditional financial systems (like lending and borrowing) on decentralized networks. Similarly, Decentralized Autonomous Organizations (DAOs) operate based on pre-set rules encoded in smart contracts, eliminating the need for hierarchical management structures.

Challenges to True Decentralization

While the promise of decentralization is immense, achieving complete decentralization is challenging. Some cryptocurrency projects have been criticized for being only partially decentralized. Factors like centralization of mining operations and the influence of large stakeholders can compromise the decentralized ethos of a project.

Challenges in Cryptocurrency Adoption

While the potential of cryptocurrencies is undeniable, their journey towards mainstream adoption is not without hurdles. This section delves into the primary challenges that have, at times, slowed the pace of cryptocurrency acceptance and integration into the broader financial landscape.

- Regulatory Hurdles

Governments and regulatory bodies across the globe have been wrestling with how to categorize and regulate cryptocurrencies. Their decentralized nature, which operates outside the traditional financial system, poses a challenge to established regulatory frameworks. This has led to a landscape where the legal status of cryptocurrencies remains ambiguous in many jurisdictions, causing uncertainty for investors and businesses alike. - Market Volatility

The cryptocurrency market is renowned for its volatility. Dramatic price swings can occur within short time frames, often influenced by a myriad of factors ranging from regulatory news to technological advancements. This unpredictable nature can deter traditional investors, who might view such assets as too risky, and can also impact the broader acceptance of cryptocurrencies as a stable medium of exchange. - Technical Barriers

For many individuals, especially those not well-versed in technology, the world of cryptocurrencies can seem complex and intimidating. Concepts such as cryptocurrency wallets, private keys, and blockchain can be challenging to grasp. Additionally, as the number of transactions on certain blockchains grows, there are concerns about networks’ ability to handle the increased load, potentially leading to slower transaction times and higher fees. - Public Perception and Trust

Despite the growing awareness of cryptocurrencies, misconceptions and skepticism persist. High-profile security breaches, fraudulent Initial Coin Offerings (ICOs), and other negative events have at times overshadowed the positive developments in the cryptocurrency space. This has led to a level of mistrust among the general public, with many viewing cryptocurrencies as either a speculative bubble or a tool primarily used for illicit activities.

Opportunities in the Cryptocurrency Space

Despite the challenges, the cryptocurrency landscape is rife with opportunities that have the potential to redefine the contours of finance, governance, and more. This section delves into the transformative possibilities that cryptocurrencies and their underlying technologies present.

- Financial Inclusion: Cryptocurrencies offer a solution to the 1.7 billion adults without traditional banking access. By enabling transactions through digital wallets, they can bring these individuals into the global economy. Additionally, cryptocurrencies promise faster, cheaper cross-border transactions, benefiting those sending international remittances.

- Investment Potential: Despite its volatility, the cryptocurrency market presents a new asset class for diversification. The growing interest from institutional investors underscores its potential returns and lends credibility to the crypto space.

- Technological Innovations: Beyond digital currencies, blockchain, the technology underpinning cryptocurrencies, has vast potential. Smart contracts and Decentralized Applications (DApps) can revolutionize various sectors, while industries like supply chain can leverage blockchain for transparency and traceability.

- Empowerment and Autonomy: Cryptocurrencies empower individuals by returning financial control to them. Transactions can be made without intermediaries, and the decentralized nature ensures resistance against censorship and external influence.

Real-world Applications and Acceptance

Cryptocurrencies, once a niche and esoteric concept, are gradually finding their way into real-world applications and gaining acceptance among businesses, governments, and the general public. This section explores the tangible ways in which cryptocurrencies are making an impact and the entities that are leading the charge in embracing them.

Retail and Commerce

The retail sector has been at the forefront of integrating cryptocurrencies into its operations. A growing number of merchants, both online and offline, are now accepting cryptocurrencies as a valid form of payment. This shift is facilitated by platforms like BitPay and Coinbase Commerce, which make it easier for businesses to handle crypto transactions. The integration of cryptocurrencies in e-commerce platforms further underscores their growing acceptance and the potential they hold in revolutionizing the way we shop.

Travel and Hospitality

The travel industry has been quick to recognize the potential of cryptocurrencies. Several travel agencies, airlines, and hotel chains now offer the option to book using digital currencies. This not only caters to a tech-savvy demographic but also simplifies cross-border transactions, making travel more accessible. Moreover, certain tourist destinations are branding themselves as “crypto-friendly,” with local businesses and services accepting digital currencies, further enhancing the travel experience for crypto enthusiasts.

Financial Services

Traditional financial institutions, once wary of the crypto wave, are now exploring avenues to integrate these digital assets. Some banks have started offering cryptocurrency trading services, while others are researching the potential of blockchain for streamlining operations. The rise in cryptocurrency ATMs globally also indicates a growing acceptance and the blending of traditional and digital finance.

Public Services and Governance

Governments and public service entities are beginning to see the potential benefits of cryptocurrencies and blockchain technology. A few jurisdictions have taken the bold step of accepting tax payments in cryptocurrencies, signaling a shift towards mainstream acceptance. Additionally, the exploration and potential launch of Central Bank Digital Currencies (CBDCs) by various governments highlight the growing recognition of digital currencies’ potential in governance and public services.

Philanthropy and Donations

The realm of philanthropy has also been touched by the wave of cryptocurrencies. Numerous charitable organizations and causes now accept donations in digital currencies. This not only allows for greater transparency in fund allocation but also opens up a new avenue for donors, especially from the younger, tech-savvy generation, to contribute to causes they care about.

Conclusion

As we reflect on the transformative journey of cryptocurrencies, it’s evident that they have evolved from a novel concept to a significant force in the financial world. While the potential is vast, challenges such as regulatory hurdles and market volatility highlight the technology’s nascent stage. However, these challenges also present opportunities for growth and refinement. Collaborative efforts between developers, regulators, and stakeholders will be pivotal in navigating these complexities and realizing the full potential of cryptocurrencies.

Looking ahead, the future of cryptocurrencies is both exciting and uncertain. Technological advancements promise solutions to current challenges, and as the benefits of decentralization and transparency become more recognized, broader adoption is anticipated. For individuals and institutions alike, engagement with the crypto space offers a chance to be part of a financial revolution that promises a more inclusive and efficient global financial ecosystem.