In recent years, the world has seen an unparalleled increase in the popularity and adoption of cryptocurrencies, transitioning from a niche market to a mainstream financial asset and revolutionizing our approach to money. However, this potential is accompanied by significant volatility. The cryptocurrency market, characterized by swift price changes, presents both immense opportunities and challenges for investors. Here, the timeless strategy of diversifying your cryptocurrency portfolio becomes crucial, balancing potential gains with risk management.

What is Cryptocurrency?

At its core, a cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized platforms based on blockchain technology. This decentralization ensures that no single entity has control over the currency, making it immune to government interference or manipulation.

Top 5 Cryptocurrencies by Market Capitalization (as of [Date]):

- Bitcoin (BTC)

- Market Cap: $XXX Billion

- Price: $XX,XXX

- 24h Change: X.XX%

- Ethereum (ETH)

- Market Cap: $XXX Billion

- Price: $X,XXX

- 24h Change: X.XX%

- Binance Coin (BNB)

- Market Cap: $XXX Billion

- Price: $XXX

- 24h Change: X.XX%

- Cardano (ADA)

- Market Cap: $XXX Billion

- Price: $X.XX

- 24h Change: X.XX%

- Solana (SOL)

- Market Cap: $XXX Billion

- Price: $XXX

- 24h Change: X.XX%

(Note: The values are placeholders. Real-time data should be inserted when finalizing the content.)

Why Diversification?

Diversification, in the context of investment, refers to the strategy of spreading investments across various assets to reduce risk. The idea is simple: don’t put all your eggs in one basket. In the volatile world of cryptocurrencies, diversification becomes even more crucial. A well-diversified portfolio can cushion against significant losses when one or more assets underperform. Moreover, it provides an opportunity to benefit from the potential upside of multiple assets, ensuring a balanced approach to crypto investing.

Understanding Cryptocurrency Volatility

The cryptocurrency market, frequently likened to the unpredictable and opportunity-rich Wild West, is rife with risks and defined by its volatility. Understanding the causes of these dramatic price swings is crucial for investors. In navigating this tumultuous market, employing the strategy of diversifying your cryptocurrency portfolio becomes indispensable, helping to mitigate risks while seizing potential opportunities.

Defining Volatility

Volatility, in financial terms, refers to the degree of variation in an asset’s price over time. A highly volatile asset can see its price swing dramatically in a short period, while a less volatile asset remains relatively stable. In the context of cryptocurrencies, volatility is often much higher than traditional financial markets, leading to both significant gains and losses in a matter of hours or even minutes.

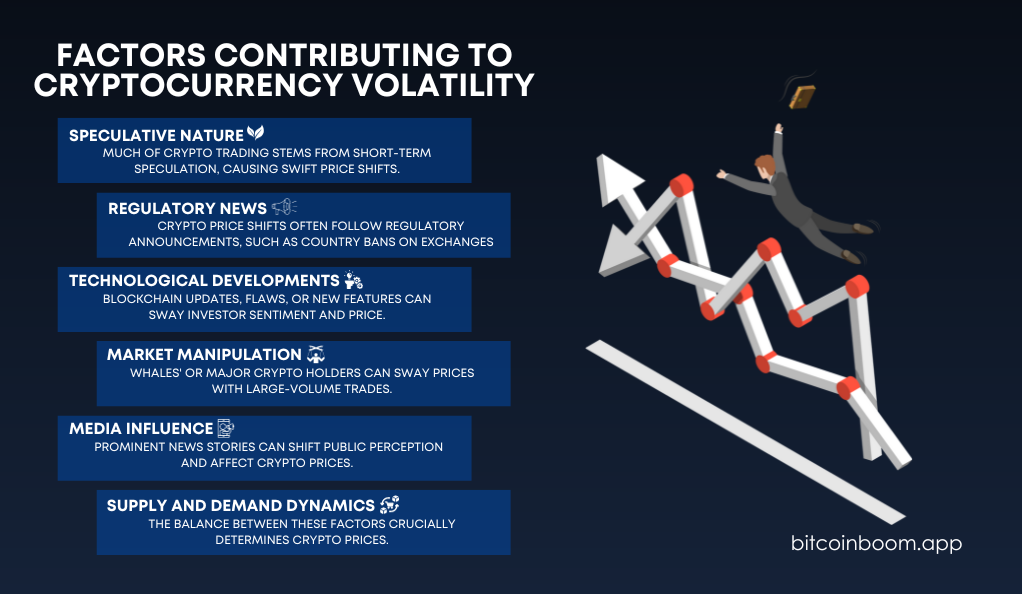

Factors Contributing to Cryptocurrency Volatility:

- Speculative Nature: A large portion of crypto trading is driven by speculation. Traders buy and sell based on short-term expectations, leading to rapid price movements.

- Regulatory News: Announcements related to cryptocurrency regulations, whether positive or negative, can cause sharp price reactions. For instance, a country banning crypto exchanges might lead to a drop in prices.

- Technological Developments: Updates or flaws in blockchain technology, or the launch of new features, can influence investor sentiment and price.

- Market Manipulation: ‘Whales’ or large holders of cryptocurrencies can influence prices by buying or selling in large volumes.

- Media Influence: News stories, especially from prominent media outlets, can sway public perception and drive price changes.

- Supply and Demand Dynamics: Like any other market, the balance between supply and demand plays a crucial role in determining cryptocurrency prices.

Major Crypto Price Swings in the Past Year:

- Bitcoin (Date: DD/MM/YYYY)

- Price Swing: -15%

- Potential Trigger: Regulatory news from China

- Ethereum (Date: DD/MM/YYYY)

- Price Swing: +20%

- Potential Trigger: Launch of a new update

- Cardano (Date: DD/MM/YYYY)

- Price Swing: -10%

- Potential Trigger: Market speculation

(Note: The values and dates are placeholders. Accurate data should be inserted when finalizing the content.)

Navigating the Waves of Volatility

Understanding the factors behind volatility is the first step in navigating it. While it’s impossible to predict every price swing, being informed and prepared can help investors make better decisions. Diversification, as we’ll explore in the upcoming sections, is one of the key strategies to mitigate the risks associated with this volatility.

Why Diversify Your Cryptocurrency Portfolio?

The age-old adage, “Don’t put all your eggs in one basket,” holds particularly true in the world of cryptocurrency. As we’ve seen, the crypto market can be a roller coaster of ups and downs. Diversifying your portfolio is a strategic move to navigate this volatility. But why is it so crucial?

Reducing Risk Through Diversification

Every cryptocurrency comes with its own set of risks, be it regulatory challenges, technological hurdles, or market competition. By diversifying, you spread these risks across multiple assets. If one cryptocurrency faces a significant downturn, the others in your portfolio can potentially offset the losses.

Potential for Higher Returns

While diversification is primarily about risk management, it also offers the potential for higher returns. Different cryptocurrencies can peak at different times. By holding a variety, you increase the chances of having a stake in the next big performer.

Ensuring Stability in an Unpredictable Market

A diversified portfolio is generally more stable than a concentrated one. While you might miss out on the full impact of a single cryptocurrency’s meteoric rise, you also avoid the devastating effects of its dramatic fall.

Exposure to Different Projects and Technologies

The crypto world is vast and varied. Different coins and tokens represent different technologies, use cases, and visions for the future. Diversifying allows you to invest in multiple facets of this exciting ecosystem.

Adapting to Market Evolution

The cryptocurrency landscape is ever-evolving. New projects emerge, older ones adapt or fade away, and market dynamics shift. A diversified portfolio is better equipped to adapt to these changes, ensuring you’re not left behind.

| Portfolio Type | Best Performing Asset | Worst Performing Asset | Overall Portfolio Return |

|---|---|---|---|

| Diversified Portfolio | Bitcoin (+25%) | Litecoin (-5%) | +15% |

| Concentrated Portfolio (Only Bitcoin) | Bitcoin (+25%) | Bitcoin (+25%) | +25% |

| Concentrated Portfolio (Only Litecoin) | Litecoin (-5%) | Litecoin (-5%) | -5% |

(Note: The table is illustrative, and values are placeholders. Accurate historical data should be inserted when finalizing the article.)

Types of Cryptocurrencies to Consider

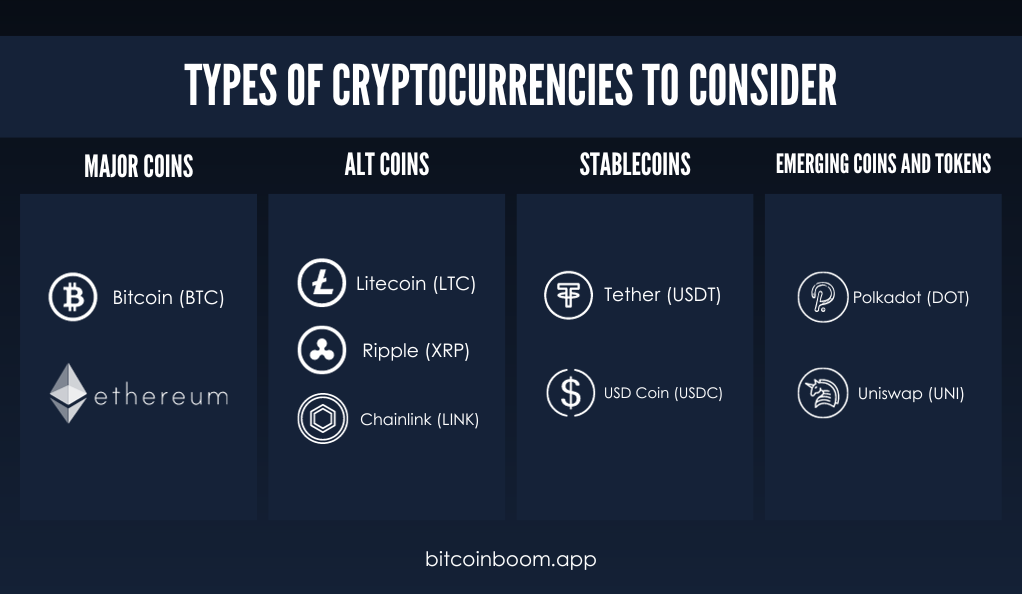

The cryptocurrency universe is vast, with over 10,000 different coins and tokens available for trade. But not all cryptocurrencies are created equal. To build a diversified portfolio, it’s essential to understand the different types of cryptocurrencies and their unique characteristics.

1. Major Coins

These are the well-established, most recognized cryptocurrencies in the market.

- Bitcoin (BTC): Often referred to as ‘digital gold’, Bitcoin is the first and most dominant cryptocurrency. It’s primarily seen as a store of value and is widely accepted for transactions.

- Ethereum (ETH): Beyond being a cryptocurrency, Ethereum introduced the concept of smart contracts, allowing developers to build decentralized applications on its platform.

2. Altcoins

These are alternatives to Bitcoin and can be quite diverse in their use cases and technologies.

- Litecoin (LTC): Created as the “silver to Bitcoin’s gold”, it offers faster transaction times.

- Ripple (XRP): Known for its digital payment protocol more than its cryptocurrency.

- Chainlink (LINK): A decentralized oracle network.

3. Stablecoins

These are cryptocurrencies pegged to a stable asset, like the US dollar, aiming to reduce volatility.

- Tether (USDT): One of the most popular stablecoins, pegged 1:1 to the US dollar.

- USD Coin (USDC): Another widely-used stablecoin, backed by a reserve of US dollars.

4. Emerging Coins and Tokens

These are newer entrants to the market, often associated with new projects or platforms.

- Polkadot (DOT): Aims to enable different blockchains to transfer messages and value in a trust-free fashion.

- Uniswap (UNI): Associated with the popular decentralized trading protocol.

Table: Market Capitalization of Selected Cryptocurrencies (as of [Date])

(Note: The table is illustrative, and values are placeholders. Accurate real-time data should be inserted when finalizing the article.)

Strategies for Diversification

Diversifying your cryptocurrency portfolio isn’t just about holding multiple coins. It’s about strategically allocating your investments to achieve a balance between risk and reward. Let’s delve into some effective strategies to diversify your crypto holdings.

1. Percentage-Based Allocation

This is the most straightforward approach, where you decide in advance how much of your portfolio will be allocated to each cryptocurrency.

- Example: 50% in Bitcoin, 20% in Ethereum, 10% in Litecoin, 10% in Chainlink, and 10% in USDC.

2. Sector-Based Diversification

Cryptocurrencies can be categorized based on their primary use cases or sectors. By diversifying across sectors, you can hedge against sector-specific risks.

- Finance: Coins like Bitcoin and Litecoin.

- Smart Contracts and DApps: Ethereum, Cardano.

- Decentralized Finance (DeFi): Uniswap, Aave.

- Gaming and NFTs: Enjin, Decentraland.

3. Diversifying Based on Technology

Different cryptocurrencies operate on different technological principles and consensus mechanisms.

- Proof-of-Work (PoW): Bitcoin, Litecoin.

- Proof-of-Stake (PoS): Ethereum (upcoming), Cardano.

- Delegated Proof-of-Stake (DPoS): EOS, TRON.

Risks and Challenges

While diversification is a powerful tool to mitigate risks, it’s not a silver bullet. Even a well-diversified cryptocurrency portfolio comes with its own set of challenges and potential pitfalls. Being aware of these can help you navigate the crypto landscape more effectively.

1. Overdiversification

While it’s essential to spread your investments, there’s a risk of spreading them too thin. Holding too many cryptocurrencies can make your portfolio difficult to manage and may dilute potential gains.

2. Lack of Research

Diversifying for the sake of diversification without proper research can be counterproductive. It’s crucial to understand the fundamentals of each cryptocurrency you invest in.

3. Emotional Decision Making

The crypto market can be a rollercoaster of emotions, with its rapid price fluctuations. Making decisions based on fear, greed, or FOMO (Fear of Missing Out) can lead to poor investment choices.

4. Ignoring Fees

Trading and transaction fees can quickly add up, especially if you’re frequently rebalancing your portfolio. It’s essential to factor in these costs when calculating potential returns.

5. Falling for Hype

In the rapidly evolving world of crypto, new projects and coins are constantly being launched, often accompanied by significant hype. It’s crucial to differentiate between genuine potential and mere noise.

Table: Common Pitfalls and How to Avoid Them

(Note: The table is illustrative and provides guidance on avoiding common pitfalls in crypto investing.)

Monitoring and Rebalancing Your Portfolio

A diversified cryptocurrency portfolio isn’t a “set it and forget it” endeavor. The dynamic nature of the crypto market necessitates regular monitoring and, at times, rebalancing to ensure your investments align with your financial goals and risk tolerance.

1. The Importance of Regular Portfolio Reviews

Cryptocurrency prices can be highly volatile. A coin that constitutes 10% of your portfolio today might grow to represent 30% in a month. Regularly reviewing your portfolio ensures that you’re aware of such shifts and can take action if needed.

2. Tools and Platforms for Tracking

Several tools and platforms can help you monitor your cryptocurrency holdings:

- Crypto Wallets: Digital wallets not only store your cryptocurrencies but often come with built-in tracking features.

- Portfolio Management Apps: Apps like Blockfolio and Delta allow you to track multiple cryptocurrencies across various exchanges.

- Exchange Dashboards: Most crypto exchanges provide dashboards that give an overview of your holdings and their performance.

3. When and How to Rebalance

Rebalancing involves adjusting your portfolio to ensure it aligns with your desired asset allocation. Here are some strategies:

- Time-based Rebalancing: Adjust your portfolio at regular intervals, e.g., quarterly or annually.

- Threshold-based Rebalancing: Make adjustments when an asset’s weight in your portfolio deviates by a certain percentage from your target.

- Tactical Rebalancing: Adjust based on specific criteria or events, such as significant news affecting a particular cryptocurrency.

| Scenario | Initial Allocation (BTC:ETH:LTC) | Allocation After 6 Months | Action Taken |

|---|---|---|---|

| A | 50%:30%:20% | 60%:25%:15% | Reduced BTC holdings, increased ETH and LTC |

| B | 40%:40%:20% | 40%:35%:25% | Reduced ETH holdings, increased LTC |

| C | 30%:30%:40% | 30%:30%:40% | No action needed |

(Note: The table is illustrative, showcasing different rebalancing scenarios based on hypothetical data.)

Conclusion

The world of cryptocurrency presents a captivating mix of potential rewards and unpredictability. As we’ve delved into, diversifying your cryptocurrency portfolio is not just a strategy; it’s a crucial practice for any investor aiming to adeptly navigate the volatile crypto environment. By allocating investments across a variety of assets, investors can reduce risks, potentially boost returns, and position themselves to capitalize on the numerous opportunities this dynamic market offers.

As the financial landscape undergoes continuous transformation, cryptocurrencies remain at the cutting edge of this significant shift. For crypto enthusiasts, both new and experienced, the path to success involves ongoing education, strategic investing, and consistent portfolio management. In the expansive world of digital assets, knowledge and a well-diversified cryptocurrency portfolio serve as guiding lights.